It’s never been more important for your sales organization to be firing on all thrusters. As buyers are tightening their purse strings and uncertainty in both health and economic spheres are plaguing companies, you need an optimized sales organization.

In our Top-Performing Sales Organization research, we studied what the organizations with the highest win rates, revenue growth, and sales goal achievement do differently that allow them to achieve these results.

Top Performance Defined

The following criteria define a Top Performer:

- Higher win rates: More on this below.

- Growth in revenue and profitability: Elite and Top Performers see increases in revenue and profitability year-to-year.

- Meet annual sales goals: To be an Elite or Top Performer, the sales organization must achieve its sales goal.

- Challenging sales goals: 82% of Top Performers agreed their sales goals are challenging. In other words, Elite and Top Performers set more challenging goals and are more likely to achieve them.

- Capture maximum prices in line with the value provided: Elite and Top Performers are more likely to capture maximum prices.

5 Key Takeaways from The Top-Performing Sales Organization Benchmark Report

While the Top-Performing Sales Organization study yielded a trove of fascinating results, the following five points stand out as highlights.

-

Performance and Win Rates

The differences in proposal win rates between performance groups were large and surprising. Elite Performers have a win rate of 73%, Top Performers 62%, and The Rest only 40%. For those looking to make the financial impact case of getting to the next level in your sales organization maturity, focus on win rate.

Improving win rate has a tremendous impact on your company’s sales results. Here’s an example illustrating the win rate difference.

-

Driving Maximum Value

We asked whether respondents agreed that “Our sales organization focuses on driving maximum value for the customer.” Elite almost universally agreed (91%), as did Top Performers (81%). Only 61% of The Rest agreed.

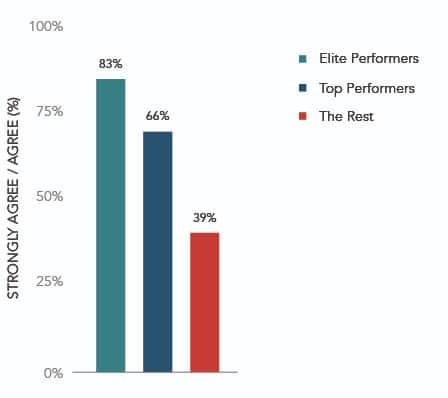

We also asked whether “Company leaders prioritize developing sellers to be as valuable as possible to buyers.” While the vast majority of Elite and Top Performers agreed, only 39% of The Rest agreed.

Company Leaders Prioritize Developing Sellers to Be as Valuable to Buyers as Possible

The lack of focus on value-based selling in The Rest, which represents 80% of respondents, is startling.

In today’s economic crisis, it’s never been more important for sellers to provide value to their customers. This data should serve as a wake-up call to leadership to make a change.

-

Huge Skill and Training Gaps

Sales training effectiveness is atrociously low in The Rest (only 14% extremely or very effective) compared to Elite Performers (51%) and Top Performers (30%). Top Performers are also 63% more likely to have an excellent or good investment in sales training. Only 27% of The Rest have an excellent or good investment.

Across skill areas, such as driving and winning sales opportunities, core and advanced consultative selling, filling the pipeline, driving account growth, and more, The Rest have significant skill deficits. In fact, only 3 in 10 of The Rest agree that sales managers have the skills they need to manage and coach sellers. This means that if you line up 10 sales managers, respondents believe 7 of them wouldn’t have the skills to do their jobs effectively.

With sellers moving remote and working from home, you need effective virtual learning for both sellers and sales managers to upskill your teams and help them deal with the challenging environment they now face.

-

Growing Strategic Accounts

It’s 5 to 7 times less expensive, and more profitable, to build additional business with existing accounts than it is to acquire new ones. The #1 factor with the greatest separation between Top Performers (61%) and The Rest (32%) is “Our sales organization is effective a maximizing sales to existing accounts."

Based on our research, it appears that organizations that are effective at strategic account management and growth do, indeed, enjoy stronger business results.

It’s never been more important to focus on your strategic accounts. Look for accounts and industries that are poised to grow in the current environment, or are future-focused, beyond the current crisis.

-

Leadership and Change

We studied both leadership’s prioritization of selling and sales force excellence, and leadership’s ability to execute. Both correlate significantly to top sales performance, with the Top and Elite Performers scoring much higher than The Rest. In fact, only 51% of The Rest agree that when leaders set a priority, it gets done, versus 69% of Top Performers.

It’s no surprise: the rigor and investment leadership allocates to sales performance makes a difference in results.

Sales organizations that are agile and can rapidly adapt to the new and changing environment are the ones that are most likely to survive and thrive.

Bonus Takeaway: There's no silver bullet.

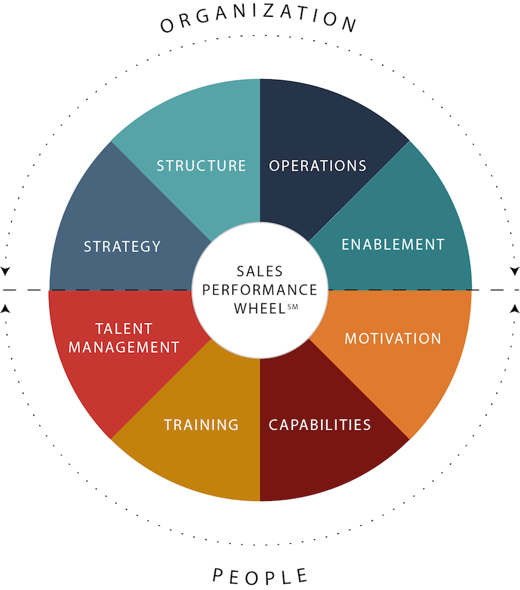

While the results of this research are fascinating, we did not find a single thing that an organization can do better to revolutionize sales results. We did, however, find that achieving the right mix across the 8 categories of the Sales Performance Wheel is extremely important.

The 8 Categories of the Sales Performance WheelSM

Click here to learn more about the 8 categories of the Sales Performance Wheel.

What any individual company needs to do to drive results depends on a thorough understanding of where they are now, where their gaps are in the wheel, and how they compare to Top Performers.

In this article, we shared some of the most interesting results looking at the Top Performers compared to The Rest. How do you stack up?

*In a global study, we analyzed data from 472 respondents in companies with anywhere from 10 to 5,000+ sellers. We broke them down into 3 performance groups: Elite Performers (top 7% of respondents), Top Performers (top 20% of respondents), and The Rest (the remaining 80% of respondents).