In the spring, the outlook for the HVAC industry, like the rest of the economy, seemed dim. New work did drop in April. But the situation soon changed. Homes suddenly became the center of people’s lives, and they wanted to invest in them. A combination of limited spending options and low interest rates provided the means to do just that.

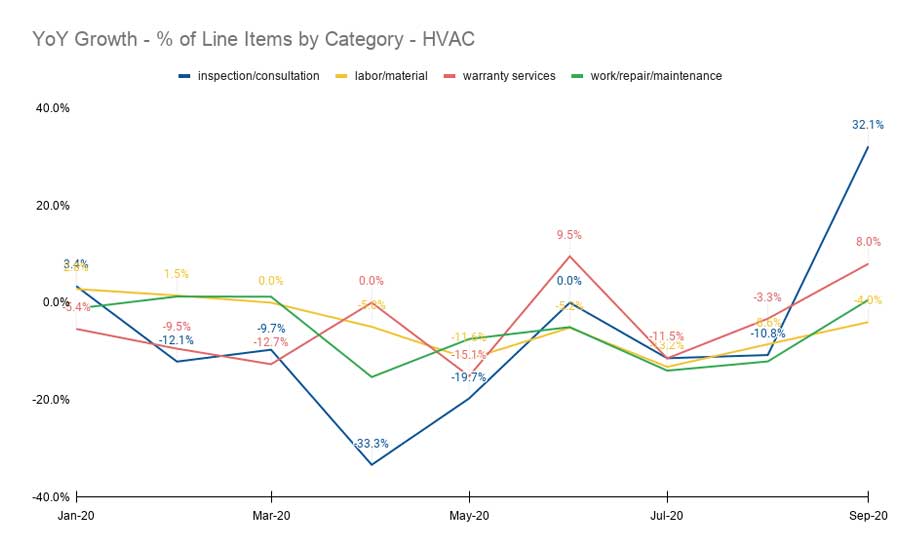

According to the most recent Home Service Economic Report from Jobber, new work scheduled for the Contracting segment (which includes HVAC) reached a record high of 15% year-over-year growth in June. From June to September, new work scheduled has been growing faster year-over-year compared to the start of the year, before the pandemic reached the United States.

“Based on those data points, we do believe that the positive growth trends should continue through the winter,” said Abheek Dhawan, Jobber’s vice president of business operations.

Cassie Morien, senior content strategist with Modernize, agrees. She pointed to an analysis from her company that shows most consumers are canceling or scaling back travel plans for the holidays, just as they did in the summer. In fact, the Centers for Disease Control are advising people to say home for the holidays, and many states have made it difficult to go visiting. Morien said the analysis didn’t touch on plans for gifts or any other holiday spending, but the travel savings alone provide enough fuel to continue investment in home improvement.

Consumers are willing to spend, but they remain cost-conscious due to continued economic uncertainty. If HVAC contractors opt to offer discounts, savings on equipment draw the most interest from consumers, followed by labor. Morien said consumers like to see savings that they can understand.

Consumers Want Energy Savings, Improved IAQ

Consumers also worry about higher energy usage now that they and their families are spending all their time at home. They keep the heat at a higher level in the middle of the afternoon. They also use a lot more electricity with multiple computers running all day. HVAC contractors can ease these concerns for them by offering energy-saving solutions, Morien said.

Shawn Whiteley, regional manager for American Standard, said energy savings can come from simple investments such as programmable thermostats. More involved solutions include using ECM motors on the indoor equipment and staged or variable speed compressors on the outdoor units.

The other major concern for people these days is indoor air quality. Whitley said the demand for IAQ products “continued to be off the charts” in the fall. Whitley said his company fully expects IAQ to remain very important for consumers for the foreseeable future. He said consumers have become much more aware of what moves through the air in their homes.

“Often times, IAQ upgrades can be done without major modifications to the system, so that makes an IAQ upgrade much easier to afford than full system or major component replacements,” Whitley said.

One trend that contractors should be paying attention to is the rise in digital payments, Dhawan said. Jobber’s data shows that there has been a significant increase in payments through digital methods rather than check or cash. The Contracting segment has been slow to adopt digital payments, he said. These businesses often have large invoice sizes, and using digital payment methods can deteriorate their margins. But taking digital payments is the kind of service customers are starting to expect, Dhawan said.

HVAC Contractors Who Offer Financing Turn Emergencies into Opportunities

More consumers are also interested in financing HVAC repairs and upgrades. At the start of heating season, most work comes from no-heat calls. Greg Cicatelli, head of enterprise home improvement sales at Ally Lending, said HVAC contractors can offer financing to turn that repair into an upgrade. This becomes especially attractive with a low-monthly payment or other type of promotion.

“The good contractors will actually turn that into a selling opportunity,” Cicatelli said.

Hans Zandhuis, president of Ally Lending, said consumers are moving toward specific financing as a way to better budget their money. Zandhuis said point-of-sale financing has grown by about 20% in the past few years, while credit card usage has been flat. At this time of year, consumers can finance an upgrade and plan on paying it off in a few months with a tax refund.

Whitley said many people avoid tapping into savings or other funds in these uncertain times. He said the greatest value to changing out older systems is normally created through increased comfort. For example, variable speed systems, while more costly at the time of purchase, create tremendous increases in comfort level for homeowners.

“Most folks don’t spend a lot of time thinking about their HVAC system until it breaks,” Whitley said. “Now that folks are spending more and more time at home, they are much more aware of the issues that may have been more easily ignored previously. That uncomfortable bedroom that has now become a home office is a little higher on the priority list than before.”

Another important emerging trend is better customer communication. Jobber found that visit reminders have been growing at over 100% year-over-year in the third quarter. The actual growth in visits is around 30-40%.

Morien said communication plays an especially crucial role these days because contractors need to show empathy for consumers. Phone call and emails are ways to do this, but texts are effective and often overlooked, she said. In fact, more than 50% prefer to communicate via text message.

“People are really stressed this year, but that doesn’t mean they don’t want to pursue these home improvement projects,” she said.

Report Abusive Comment